In today's competitive business environment, efficiency isn't just a goal but a necessity. Organizations often find themselves asking - or being asked - critical questions about their financial processes. Are they fast enough? Are they cost-effective? Are manual methods holding back growth? Are employees juggling spreadsheets and missing deadlines?

These concerns are all valid, especially when small businesses are managing Accounts Payable (AP), which can be time-consuming and prone to error without the right tools in place.

The accounts payable solution in this case? Software designed for small businesses. However, it’s important to select the right accounts payable software tailored to your specific needs, budget, and existing accounting systems.

The Problem with Traditional AP Methods

For many years, small businesses have relied on manual methods - like paper invoices and spreadsheets - to handle their AP processes. While these tools served their purpose in the past, they've now become somewhat outdated symbols of inefficiency. Today traditional methods struggle with managing invoice data efficiently.

Manual methods are slow, susceptible to errors, and hard to scale especially as businesses grow. At a time when technology is helping to drive down costs and boost productivity, it's becoming clear that these outdated processes – especially manual invoice processing - are no longer sustainable.

Surprisingly, despite this, many small businesses still use these inefficient tools to manage invoices and payments. A survey by IDC Global revealed that 64% of respondents continue to use spreadsheets for some part of their payment processes.

It’s time for small businesses to think bigger. To thrive, they need to adopt modern, automation solutions.

What is Accounts Payable Automation?

Accounts Payable (AP) automation uses software to digitize and streamline the entire invoice-to-payment process. The software eliminates manual tasks such as data entry, invoice matching, and payment approvals, capturing and processing invoice data while reducing human error and improving workflow efficiency.

This digital solution helps businesses to efficiently manage vendor payments, communications, and invoices while reducing the risk of errors and delays. For businesses of all sizes, adopting this technology is an important step towards achieving greater efficiency and accuracy in their financial operations. For small businesses in particular, AP automation drastically cuts down on processing time and costs while providing better financial visibility and control.

Furthermore, by integrating the AP automation solution with existing ERP or accounting systems, businesses can achieve seamless data synchronization and ensure accuracy across all digital records. This integration provides visibility into cash flow, provides real-time updates on payment statuses, and creates a unified, efficient process that supports better decision-making. It also simplifies compliance by maintaining a digital audit trail - critical for meeting regulatory requirements and reducing the risk of fraud.

Why AP Automation is Essential for Small Businesses

Why AP Automation is Essential for Small Businesses

There is often a misconception that AP automation is only for large enterprises. However, with the rise of cloud-based solutions, small businesses can now easily access these tools without hefty investments. And, by adopting accounts payable software, small businesses can overcome common pain points such as lost invoices, delayed approvals, and late payments. This turns what was once a bottleneck into a streamlined, efficient, and reliable accounts payable process.

Key Features of Accounts Payable Software

Accounts payable software comes equipped with a variety of features that help businesses automate and streamline their accounts payable process. Here are some of the key features that make this software indispensable:

- Invoice Automation: This feature automates the capture, processing, and approval of invoices, reducing the time and effort previously required for manual data entry.

- Accounts Payable Automation: By automating bill payments and cash flow management, this feature ensures timely payments and better financial control.

- Data Entry Automation: The software automates the entry of data into accounting systems, typically using Artificial Intelligence (AI) and Deep Learning (DL) to ensure accuracy, reduce errors, and save valuable time.

- Accounts Receivable Management: Some accounts payable software also includes tools for managing accounts receivable, providing a comprehensive financial management solution.

- Accounting Software Integration: Seamless integration with existing accounting software ensures consistency and accuracy across all financial records, departments, and locations.

- Invoice Processing: Efficiently processes and approves invoices, speeding up the accounts payable process and improving financial efficiency.

- Approvals: Accounts Payable software automatically routes invoices for approval according to predetermined parameters. By efficiently managing invoice data, cloud-based software ensures smooth and timely approvals.

- Cash Flow Management: Helps businesses monitor and manage their cash flow in real-time, enabling informed financial decisions and better financial health.

Together these features enhance the efficiency and accuracy of the accounts payable process, making accounts payable software a vital tool for small businesses.

Four Benefits of Accounts Payable Automation for Small Business

1. Enhanced Cash Flow

Manually processing invoices is both time-consuming and costly. Implementing automation software into your AP process results in efficient management of invoice data that reduces costs, helps capture early payment discounts, and avoid the risk of late payment fees. These improvements have a direct positive impact on your cash flow and overall financial health.

Furthermore, integrating accounts receivable automation streamlines both invoicing and payment collection, creating a more complete and effective cash flow management system.

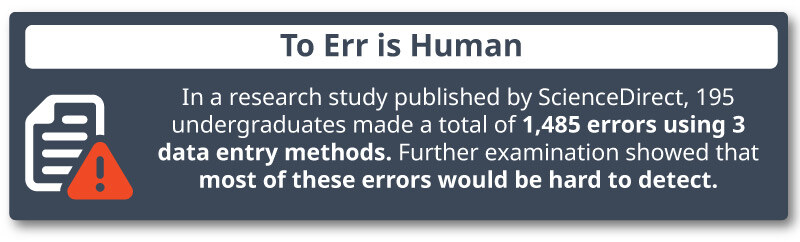

2. Improved Accuracy

According to a study by the Journal of Accountancy, manual data entry has a human error rate ranging from 1-5%. Automation virtually eliminates these errors, ensuring data is processed correctly.

3. Faster Payments

Traditional methods often lead to late payments. According to research from the 2024 State of Automation in Finance report, 48% of US finance leaders cite validating invoices as the primary reason for late invoice payments, followed by slow processing and approval at 38%.

In addition, efficient handling of invoice data via automation speeds up the payment process, allowing businesses to capture early payment discounts and avoid late fees. This in turn can strengthen your relationships with vendors, leading to better terms and more reliable partnerships.

4. Streamlined Workflow

With manual processes, it can take weeks to process an invoice. Automated accounts payable solutions are designed to enhance business efficiency, working 24/7 can reduce this to minutes and free up valuable time for your team. They efficiently manage invoice data, quickly and securely recording, storing, and processing financial documents.

Saving Time and Money with Accounts Payable Software

One of the biggest advantages of AP software for small businesses is its ability to quickly handle invoices in any format, whether they come in via paper, email, or even fax. Cloud-based platforms like Yooz make it easy to set up in as little as a single day, allowing businesses to start automating their AP processes quickly.

Once an invoice is submitted, the software automatically extracts and processes invoice data, matches that data with purchase orders, and flags potential discrepancies, removing the need for manual data entry. This not only reduces errors but also gives small business owners more time to focus on strategic, growth-related activities.

Once an invoice is submitted, the software automatically extracts and processes invoice data, matches that data with purchase orders, and flags potential discrepancies, removing the need for manual data entry. This not only reduces errors but also gives small business owners more time to focus on strategic, growth-related activities.

In essence, accounts payable software transforms the entire AP process from a time-consuming chore into a streamlined, efficient operation that saves both time and money.

The Power of Cloud-Based Approvals

With accounts payable automation, small businesses can approve invoices from anywhere, at any time. Cloud-based software allows finance teams to create customized approval workflows, ensuring that invoices move through the system without delays. Whether in the office or working remotely, the right people can approve payments with a simple click, speeding up the process and improving efficiency.

Simplifying Payments

Once an invoice is approved, AP automation platforms make the payment process simple. Small businesses can choose from a variety of payment methods such as ACH, virtual cards, or checks, and schedule payments based on their preferred schedule and cash flow needs.

With just a few clicks, you can complete the process, from selecting the invoice to be paid to scheduling the payment, all while keeping accurate records for future reference. Small businesses also benefit from incentives like cash-back rewards when using virtual cards for payments, turning AP automation into a revenue-generating opportunity.

Strengthening Vendor Relationships

Automated accounts payable software does more than make your business more efficient; it also improves vendor relationships. Vendors always know where their invoices stand, reducing the need for constant follow-up calls or inquiries about late payments. This level of transparency fosters stronger partnerships, and ensures that vendors are paid on time, every time.

Seamless Integration with Your Accounting Software

For small businesses already using accounting or ERP systems like QuickBooks or Oracle NetSuite, accounts payable software integrates seamlessly, providing real-time updates and ensuring consistency and accuracy across platforms. This eliminates manual data entry, reduces the risk of errors, and creates a digital audit trail for compliance and security purposes.

Unlocking Competitive Power with AP Automation

By adopting modern AP software, small businesses can achieve significant cost savings, improve accuracy, and streamline workflows without requiring large upfront investments in new technology. Here is a quick summary of why AP automation is so beneficial:

- Cost-effective: AP automation reduces processing costs by up to 80%.

- Scalable: Cloud-based platforms allows businesses to scale their operations as they grow.

- Efficient: Processing times are reduced from weeks to minutes, saving your team valuable time.

- Compliant and Secure: Automated systems ensure compliance and reduce the risk of fraud.

Choosing the Right Software for Your Accounts Payable Process

Selecting the right accounts payable software is necessary for maximizing the benefits of automation. Here are some key factors to consider when choosing the right software for your business:

- Scalability: Ensure the software can grow with your business. It should be able to handle an increasing volume of transactions as your business expands.

- Ease of Use: The software should be user-friendly and easy to navigate. A steep learning curve can hinder adoption, possibly alienate employees, and reduce efficiency.

- Customer Service: Look for a software provider that offers excellent customer service and support. This is essential for resolving any issues quickly and ensuring a smooth operation.

- Integration Capabilities: The software should integrate seamlessly with your existing accounting systems and other financial tools. This ensures consistency and accuracy across all platforms.

- Cost: Consider the cost of the software and ensure it fits within your budget. While it’s important to invest in quality software, it should also provide good value for money.

By carefully evaluating these factors, small businesses can choose the right accounts payable software to enhance their financial efficiency and support their growth.

Conclusion: The Future is Automation

In an unpredictable business world, having the right technology in place is crucial to long-term success. For small businesses, accounts payable automation offers a simple yet powerful way to securely increase efficiency, reduce costs, and build better vendor relationships.

Now, thanks to cloud-based solutions, small businesses now have access to the same tools as large enterprises, leveling the playing field and securing their future.

Don't let manual AP processes hold your business back. Unlock the potential of AP automation today and take your business to the next level!

FAQs

What is Accounts Payable automation?

Accounts Payable (AP) automation leverages technology to streamline the invoice-to-payment process by reducing manual tasks, enhancing efficiency, and minimizing errors.

What does Accounts Payable automation mean for small businesses?

AP automation helps small businesses reduce processing times, lower costs, and improve accuracy, ultimately increasing efficiency and cash flow visibility.

Is AP automation only suitable for large organizations?

No. Especially with the rise of cloud-based solutions and software, AP automation is easily accessible to small businesses.

What features should a small business look for in accounts payable software?

Key features to look for include invoice automation, data entry automation, integration with existing accounting software, approval workflows, and real-time cash flow management.

How does AP automation improve cash flow management?

By automating invoice processing and payment scheduling, AP automation ensures timely payments, helps capture early payment discounts, and avoids late fees, all of which contribute to better cash flow management and financial control.

Can AP automation integrate with my current accounting system?

Yes, most AP automation software integrates seamlessly with popular accounting or ERP systems, providing real-time updates, reducing errors, and ensuring consistency across platforms.