Accounting and Finance departments of all sizes have seemingly spent years discussing the merits of Accounts Payable automation.

A report produced by Levvel Research and sponsored by Yooz suggests that the profession has finally moved on. Accounts Payable leaders are now focused on how to automate, rather than “why”.

This is welcome news in a profession where manual, repetitive tasks have resulted in processes that cost too much, take too long, create too many errors, provide inadequate visibility, and frustrate suppliers and stakeholders.

Why Should We Automate Accounts Payable?

We all likely the know the answer by now.

As the 2019 Payables Report by Levvel Research states “One of the most effective ways to improve an organization’s bottom line is to decrease the cost of operations that do not directly contribute to profit, redirecting the freed resources towards strategic, profit-generating initiatives. Automating accounts payable (AP) processes is a perfect example of this opportunity, as it not only reduces the footprint of a high-cost administrative department, but it also creates an opportunity to generate revenue through increased efficiency”.

The consequences of processing invoices in a manual or semi-automated manner are well illustrated by the top pain points that an Accounts Payable team experiences in their approval workflows:

- Time consuming and error ridden manual data entry and inefficient processes

- Manual routing of invoices for approval

- Lost or missing invoices

- Majority of invoices received in paper format

- Lack of visibility into outstanding liabilities.

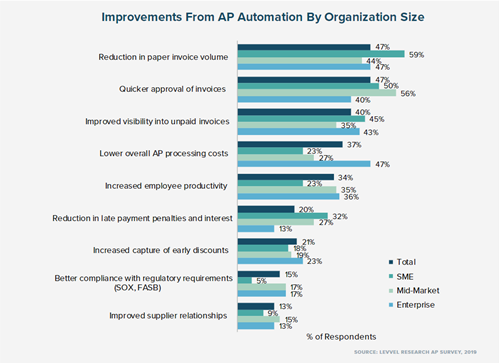

Companies are attempting to eliminate these pain points by automating their invoice and payment process, creating a touchless invoice environment. According to the Levvel report the greatest overall improvements from automating Accounts Payable are a reduction in paper invoice volume and faster invoice approvals.

Levvel also reports that there are a few benefits that occur when businesses have a touchless invoice and payment process:

- Reduction in paper invoice volume and the elimination of filing cabinets full of paper documents

- Quicker and more efficient approval of invoices

- Improved visibility into unpaid invoices

- Lower overall Accounts Payable costs

- Increased employee productivity and satisfaction.

While most U.S. organizations still receive most of their vendor invoices in unstructured formats such as paper and e-mail, enterprises have made significant headway in pushing their supplier invoices to a portal or XML/EDI format, which typically require little or no human operator intervention. Paper accounts for only 22% of the supplier invoices received by enterprises, per Levvel Research. What’s more, 65% of enterprises now use an automated solution to capture invoice data. And half of all Accounts Payable departments use an automated software solution to route invoices for approval.

As more Accounts Payable departments embrace automation to support strategic initiatives such as digital transformation and business growth, we believe that it will be imperative for organizations to find solutions that combine cloud interconnected systems, real-time visibility into back-office processes and financial data, and collaborative tools that facilitate better and faster decision-making.

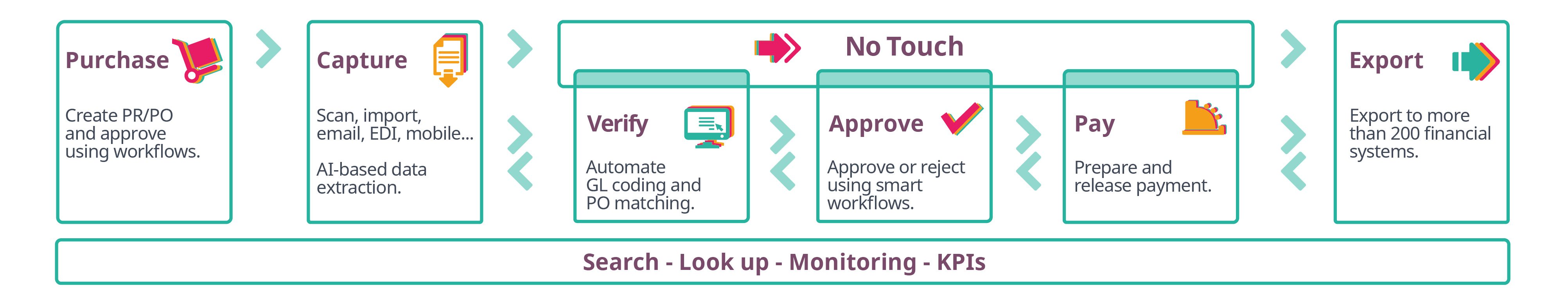

With the justification for invoice and payment process automation arguably settled, the question becomes: What is the best approach to automation of the entire procure to pay process for achieving optimum benefits?

How to Automate Accounts Payable

Start by looking in the Cloud. More Accounts Payable departments are avoiding homegrown invoice approval solutions and the tools built into their enterprise resource planning (ERP) or accounting applications for cloud-based solutions, and we agree with that approach. The percentage of Accounts Payable departments that use cloud-based solutions more than doubled between 2018 and 2019 (from 22% to 49%)1.

Why the stronger demand? One reason is that Accounts Payable departments that use cloud-based systems are more confident that their solution uses modern and cutting-edge technology. In the case of the Yooz solution, we offer the critical smart data extraction technology, powered by A.I. and machine learning.

Emerging technologies such as RPA, AI, and machine learning will play a big role in automating the manual, repetitive processes that have bogged down Accounts Payable teams over the years and prevented the function from focusing on value-added tasks. Yooz learns the more you use it and will take care of all of the repetitive and mundane work for you. Although Accounts Payable departments are not as familiar as you might think with emerging technologies such as blockchain and predictive analytics, look for these technologies to have a big impact on how invoice and payment processing workflows operate in the future.

Levvel Research agrees that cloud-based best-of-breed invoice and payment process automation solutions are increasingly flexible, dynamic and affordable. With a cloud-based solution, Accounts Payable departments do not need to overhaul their legacy ERP system to in order to accommodate an invoice approval feature that their ERP does not support. The good news for organizations looking for automated Accounts Payable solutions is that more cloud-based solutions are compatible with many different ERP systems. As evidence of this agnostic approach to ERPs, Yooz seamlessly integrates with more than 250 different ERPs—more than any other AP automation solution on the market.

Cloud-based solutions also reduce costs, improve control, and speed cycle times with capabilities such as real-time access to data, mobile applications, and supplier self-service portals.

The Most Important Considerations When Automating Accounts Payable

Next, consider only complete, end-to-end workflow solutions. Beyond ERP integration, automating the invoice and payment process requires addressing five core tasks:

- Invoice receipt

- Invoice management

- Electronic payments

- Reporting and analytics

- Supplier management.

Levvel Research finds that Accounts Payable departments are prioritizing solutions with features for:

- Electronic payments

- Purchase order workflow automation

- Front-end imaging and automated data capture

- Invoice workflow automation

- Electronic invoicing capabilities.

The best cloud-based invoice and payment process automation solutions, such as the Yooz platform, either support these features, or provide functionality for them natively or via their integrated partners.

In short, companies that want to stay current with business practices, particularly when it comes to digitizing the Accounts Payable function, should consider cloud-based, smart invoice and payment process automation solutions that leverage today’s most advanced technologies and provide a complete end-to-end workflow. Like we say at Yooz, Cloud P2P Automation. Easy. Powerful. Smart.

This blog is based on the abstract of the Levvel Research 2019 Insight into Payables Report “Accounts Payable Automation: From Why? To How?” written by Mark Brousseau, consultant, Institute of Finance Management (IOFM) spokesperson, and Accounts Payable automation subject matter expert.

If you are like other top Finance and Accounting leaders and have finally taken the leap from “Why should I automate my AP process?” to “How do I automate my AP process?” then it’s time for us to chat!

FAQs

What are the first steps a company should take to automate its accounts payable process?

How does Yooz handle invoice processing and approval workflows?

Can Yooz integrate with our existing ERP or financial management system?

What kind of ROI can we expect from automating accounts payable with Yooz?