Paper. Stacks and stacks of paper. Intimidating to see and even more time-consuming to process. In an era where many finance department leaders are focused on boosting productivity, manual accounts payable process are simply too inefficient. Accounts Payable (AP) teams often find themselves overwhelmed, resulting in delays, errors, and higher operational costs.

The good news is that there is a more effective approach, a fast-track process that eliminates bottlenecks: automation. Many organizations are now turning to automated invoice processing to streamline their invoice approval process, reducing bottlenecks, enhancing accuracy, and improving overall efficiency.

What is the Invoice Approval Process?

The invoice approval process is a series of stages that an invoice goes through from receipt to payment. While the actual workflow will vary depending on the company size and needs, all invoice approval workflows will include some form of 5 basic steps:

- Receive: Capture invoices from all sources - whether by paper, email, or electronic submission - and ensure that they are properly entered into the accounts payable system.

- Capture: Extract key data from each invoice and enter them into the system, either by manual data entry or software extraction.

- Verify: Verify supplier information and verify the accuracy of the invoice details. This includes matching invoices with supporting documents such as purchase orders, contracts, and receipts to ensure that every charge is accounted for and properly authorized.

- Approve: Route the invoices to the appropriate personnel for review and approval following a predefined approval workflow. This may occur either via physical routing, emailing, or electronically.

- Pay: Once approval is obtained, the final step is to schedule and pay. This may also involve capturing any available early payment discounts.

Each of these steps can be a bottleneck, slowing down the workflow and increasing the chance or errors.

The Cost of Delays

Delays in the invoice approval process can have a significant impact on an organization's cash flow and strain vendor relationships. Late payments may lead to missed early payment discounts, damaged partnerships, and even potential penalties.

In today's fast-paced business environment, where a stable supply chain is crucial to success, speed is both an advantage and a necessity.

Manual Versus Automated Processes

Manual

Manual invoice approval processes are labor-intensive, error-prone, and slow. It requires significant human involvement at each stage of the process, from capturing invoice details to invoice approval rules for routing for approval. This often results in delays and higher operational costs.

Automated

In contrast, an automated invoice approval process leverages technology to perform these same tasks with minimal human intervention. Automation not only speeds up the process but also increases accuracy, reduces costs, and provides real-time visibility into the workflow.

Challenges of a Manual Process

While a manual invoice approval process presents numerous challenges, here are some of the most significant ones:

- Delays in Processing: Manual data entry and invoice routing take time, often leading to missed deadlines.

- Human Errors: Issues such as typos, duplicate payments, and incorrect coding are common human errors found in manual processes.

- High Operational Costs: The time and resources required for manual processing - paper, processing, storage, labor, and more - can quickly add up.

- Limited Visibility: Manually tracking the status of an invoice and retrieving historical data can quickly become complex and frustrating.

- Compliance Risks: Manual processes are more prone to errors that can lead to internal and external compliance risks.

IDC. Digitizing Accounts Payable and Receivable to Boost Efficiency and Enable Growth

The Benefits of Automation

An automated workflow transforms a time-consuming and complex process into a streamlined, efficient one. Free from hunting down invoices and chasing approvals, organizations can see a future of greater efficiency, accuracy, and costs savings.

Here are some of the most significant benefits of adopting an automated invoice workflow:

- Speed: Automation can significantly reduce processing times, allowing invoices to be approved in days or even hours.

- Accuracy: Automated systems quickly check and recheck data, reducing errors and ensuring accurate payments.

- Cost: By reducing manual labor and paper-related costs, automation reduces operational costs.

- Visibility: Thanks to real-time tracking capabilities, teams can monitor the status of invoices at any stage of the process and swiftly retrieve data, enabling more informed and strategic decision-making.

- Compliance: Automated workflows adhere to regulations and provide an audit trail, reducing the risk of non-compliance and potential legal penalties.

Speeding Up the Invoice Approval Workflow

Automation is a powerful solution for accelerating the invoice approval workflow, one that transforms how invoices are processed from purchase order to payment. This proven strategy not only speeds up the workflow, it also ensures accuracy and oversight. This makes it an indispensable tool for modern finance departments.

Automation is a powerful solution for accelerating the invoice approval workflow, one that transforms how invoices are processed from purchase order to payment. This proven strategy not only speeds up the workflow, it also ensures accuracy and oversight. This makes it an indispensable tool for modern finance departments.

Automation is a powerful solution for accelerating the invoice approval workflow, one that transforms how invoices are processed from purchase order to payment. This proven strategy not only speeds up the workflow, it also ensures accuracy and oversight. This makes it an indispensable tool for modern finance departments.

Where is the Proof?

According to independent research firm Paystream Advisors, organizations that implement automation invoice approval automation solutions have achieved notable results. These include:

- 92% faster invoice processing.

- Cost reductions between 60-80%.

- Processing 55-80% of invoices without human touch.

The proof is in the numbers: invoice automation software delivers tangible benefits.

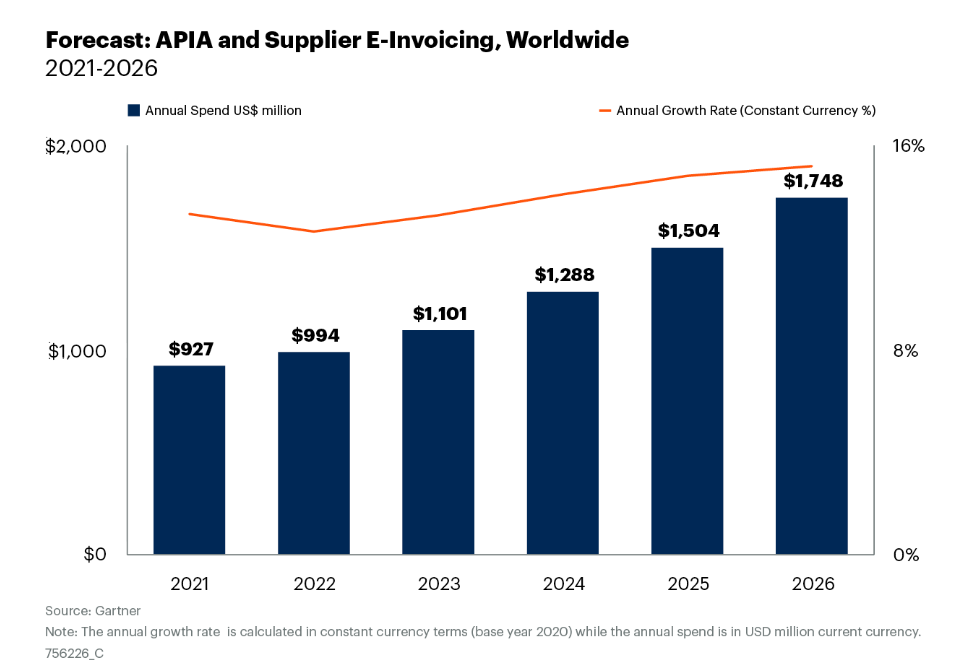

And with all the benefits, the expenditure on accounts payable automation and supplier electronic invoicing software continues to grow. Gartner predicts that by 2026 this number will reach nearly $1.75 billion, up from around $925 million in 2021.

In Just a Few Words

Putting it simply, eliminating bottlenecks in manual workflow simplifies and streamlines invoice approval processes, leading to improve service and faster payments. This results in more satisfied departments, stronger vendor relationships, streamlined cash flow, and improved overall organizational efficiency.

Time to Yooz!

Yooz is an all-in-one solution designed to automate every stage of your invoice approval process, significantly reducing manual effort and minimizing errors. Our advanced expertise in automatic document and invoice data processing is unmatched, and our cloud-native platform - designed specifically to run in the cloud - is both powerful and reliable.

Recognized by prestigious awards and trusted by businesses worldwide, Yooz stands out in the financial automation software marketplace. With Yooz, you're not just optimizing your processes, you're accelerating into the future of financial management.

The AP Automation Action Plan

Here are two actionable steps that you can take to supercharge your automated invoice approval workflow process:

- Schedule a free personalized demo with Yooz here

Experience firsthand how Yooz can streamline your invoice approval process. See how automation can transform your workflow, unlock new efficiencies, and address your concerns. - Explore our resources and blogs on accounts payable and automation

Dive deeper into accounts payable and automation by visiting our blog or resource section. Discover the latest insights, rips, and strategies to enhance your AP processes.

Take these steps today and unlock your potential with Yooz!

FAQs

How can I improve my invoice approval workflow?

How can an organization ensure transparency and accountability in their invoice approval process?

What if I already have an accounting or Enterprise Resource Planning (ERP) system in place?

What are the benefits of automating the invoice approval process?

-

- Speed

-

- Accuracy

-

- Cost

-

- Visibility

-

- Compliance