Being late for a meeting and keeping your team or partners waiting is more than just an inconvenience - it's often an embarrassment. However, being late or making mistakes when paying a vendor's invoice is a completely different matter, one with far-reaching consequences. Delayed or incorrect payments can lead to financial penalties, strained relationships, and disruptions in the supply chain.

Deciding to automate vendor payments using vendor payment software can transform your Accounts Payable (AP) process, offering benefits that extend across the entire organization.

The High Stakes of Vendor Payments

Late payments can have significant repercussions. For the organization, they can result in late fees, missed early payment discounts, and increased administrative costs due to the need for issue resolution. For vendors, delayed payments can result in cash flow challenges, possibly affecting their ability to deliver goods and services promptly. Consistent payment issues can erode goodwill, leading to less favorable terms or even the termination of vendor relationships.

A smartpayment automation solution will solve all those challenges. A business that has an automated end-to-end workflow in place can process invoices on time, every time - accurately, securely, and at scale. Automated payment processes also ensure compliance with industry standards and streamline data transfer between systems This makes your vendors happy, saves you significant amounts of time and money, and provides flexible options to pay vendors, boosting team morale and all-around job satisfaction.

What is Vendor Payment Software?

Vendor payment software is a digital solution designed to streamline and automate the process of paying vendors and suppliers. It automates tasks from invoice processing to payment execution, reducing manual data entry and errors while providing real-time visibility into payment status.

This technology enables businesses to ensure timely payments, improve cash flow management, take advantage of early payment discounts, and strengthen vendor relationships.

By focusing on efficiency and accuracy, vendor payment software supports better financial management and fosters smoother operations.

Embracing Automation

Automation provides a significant strategic advantage, ensuring that vendor invoices are processed promptly, accurately, and securely. It reduces manual intervention, minimizing errors and freeing up employee time for other tasks. Furthermore, it supports positive vendor relationships and contributes to the organization's financial health.

Choosing the Right Solution

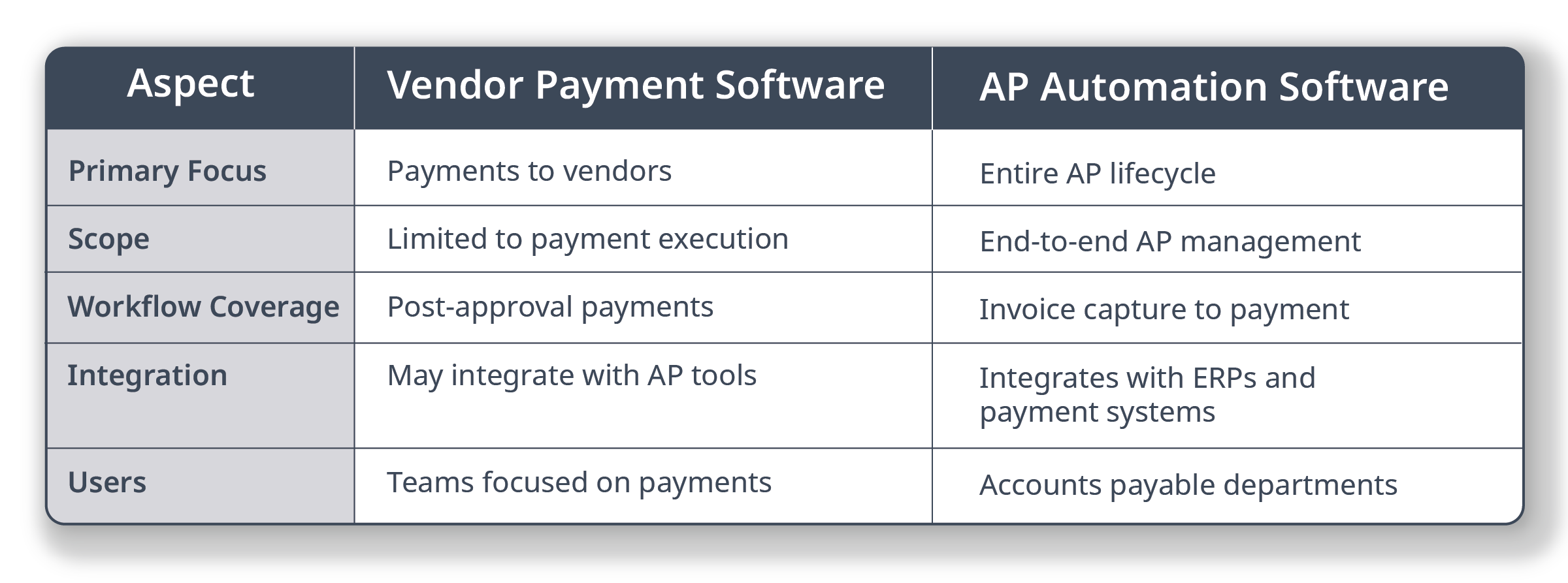

If payment execution is the bottleneck, implementing vendor payment software that integrates with existing accounting software may be enough. However, if the entire Accounts Payable (AP) process needs improvement, AP automation software is the better choice, as it typically includes vendor payment features along with comprehensive AP process management from invoice receipt to payment.

In both cases, a vendor management system can be crucial for managing compliance with local regulations and reducing risks in cross-border payments.

Key Features of Vendor Payment Software

Implementing vendor payment solutions, either independently or as part of a comprehensive AP automation platform, results in a more efficient AP process that supports positive vendor relationships and contributes to the organization's overall financial health.

1. Invoice Capture and Data Extraction

Modern solutions use advanced, AI-based technologies to capture invoices in various formats: paper, email, or electronic. Intelligent data capture systems extract relevant information without the need for manual data entry, reducing errors and speeding up the process.

2. Automated Matching and Validation

The software automatically matches invoices with purchase orders and receiving documents, a process known as three-way matching. This ensures that only accurate and authorized invoices proceed for payment, safeguarding against fraud and discrepancies.

3. Customizable Approval Workflows

Customizable approval workflows allow for flexibility in handling invoices based on predefined rules and approvers, such as invoice amount thresholds or specific vendor requirements. This customization ensures compliance with internal policies and accelerates the approval process.

4. Secure Payment Processing

Integrated payment segments enable the scheduling and execution of payments directly through the platform. Support for various payments methods - ACH, virtual credit cards, and more - ensures timely payments and can offer additional benefits such as cashback incentives.

5. Real-Time Tracking and Reporting

Comprehensive user dashboards provide visibility into the status of invoices and payments. Realtime data supports informed decision-making and improves financial management.

6. Seamless Integration with ERP Systems

Effective vendor payment software seamlessly integrates with existing Enterprise Resource Planning (ERP) systems and accounting software, ensuring data consistency and streamlining financial operations.

7. User-Friendliness and Customer Support

When choosing vendor payment software, prioritize user-friendliness and reliable customer support offered by the provider. An intuitive interface ensures ease of use for all skill levels, while dependable support is crucial in case of any issues or concerns that may arise during the payment process.

8. Cost-Efficiency and Scalability

Cost-efficiency and scalability are critical factors to consider when evaluating vendor payment software. A cost-efficient solution should deliver a clear Return On Investment (ROI) and help businesses reduce costs associated with manual payment processing.

Scalability ensures that the software can grow with the business and adapt to changing payment needs. Look for providers that offer flexible pricing models, like subscription-based or pay-per-use, and can support large volumes of payments.

Conclusion

Implementing a vendor payment software solution is a strategic move that can transform any organization's accounts payable process, leading to improved efficiency, cost savings, and stronger vendor relationships. By automating invoice processing and payment workflows, your organization can ensure that vendor payments are on time, every time, positioning your business for sustained success in a competitive marketplace.

Ready for More?

Learn more about the Yooz solution for eliminating slow manual payment processes using payment automation. Features such as YoozVendorStatements and YoozPay empowers your organization to streamline payment workflows, improve accuracy, and gain greater financial control.

The Yooz comprehensive approach takes your financial operations to the next level, ensuring that your business stays agile and competitive.

FAQs

What does vendor payment software do?

Vendor payment software lets you automate and manage vendor payments, reducing manual effort in processing multiple invoices.

What is the point of real-time tracking?

Real-time tracking provides accurate data for strategic decision-making, helping to maintain tight control over the organization's cash flow.

What are some of the benefits of vendor payment software?

The software delivers a wide range of advantages across an organization. These include strengthening vendor relationships, streamlining operations for greater efficiency, reducing costs, and improved cash flow management, and improving fraud prevention and compliance efforts.