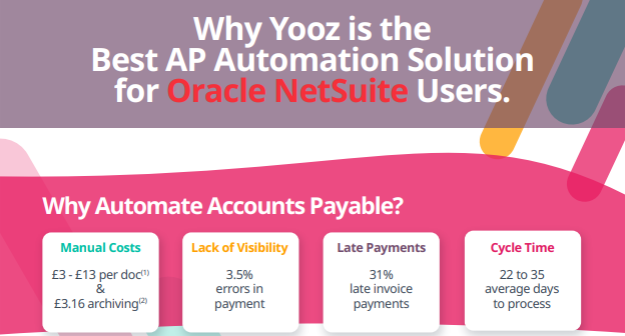

Accounts payable (AP) is a function that’s easy to overlook until something goes wrong. Money owed to other companies, partners and suppliers needs to be paid, on time and within budget. When it isn't, that’s where things become difficult, with relationships becoming strained and even the possibility of fines and legal issues. It’s a vital part of keeping a business’ finances in check, which is why reducing risk and the threat of error is one of the top priorities for finance leaders.

Unfortunately a lot of the risk associated with the accounts payable function is down to human error - a decimal point in the wrong place, an extra zero added onto the price, or even mislaying paper documents around the office.

Manually processing invoices is time-consuming, resource intensive and error-prone. Luckily automated invoice processing is here to save the day, transforming entire operations.

What is Accounts Payable automation and how does it work?

Accounts payable has long been ripe for transformation. The repetitive nature of the job makes it an obvious area that can stand to significantly benefit from the help of the technology. AP automation is revolutionising the role of the accounts payable professional, as no one wants to be spending days on end manually inserting numbers into a spreadsheet, or get into trouble because they’ve made a genuine mistake.

Originally arriving via the post, the digitalisation of invoices now means invoices can come from various sources and formats - from emails and finance platforms to PDFs and Word documents. Using automatic document reading (ADR) and smart data extraction, AP automation is able to scan the information held on any variation of an invoice - such as the recipient address, amount owed and tax codes - and, most importantly, understand it.

From there, the technology correlates the data into categories which can be viewed, accessed and sorted by accounts payable teams to streamline and simplify the entire process.

What is Oracle NetSuite?

NetSuite is a cloud business management platform from Oracle that includes everything from ERP and financials to CRM and e-commerce. The platform is used by more than 26,000 organisations globally to help run their entire businesses and drive significant performance improvements.

The software provides full visibility into key aspects of how a business is performing, from financials and inventory management to marketing and sales. But from an AP perspective, it’s the addition of automation where the benefits will truly be witnessed.

Automated accounts payable in NetSuite helps cut invoice processing time and costs, but it’s also a key tool in helping businesses and accounting finance departments remain compliant.

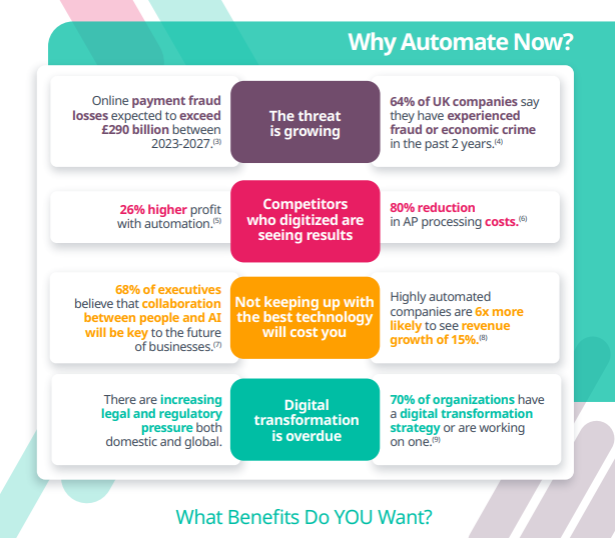

Initiatives such as Making Tax Digital (MTD) represent increasing regulatory pressure on businesses to adopt electronic invoicing. But ultimately, they are there to protect businesses, which is important as 39% of UK businesses have reported a cybersecurity breach or attack over the past 12 months.

In the digital age, businesses need platforms like Netsuite to operate, but finance teams also need specialised, automated tools that free up their time to concentrate on other, more critical tasks.

How does Oracle NetSuite work with Yooz?

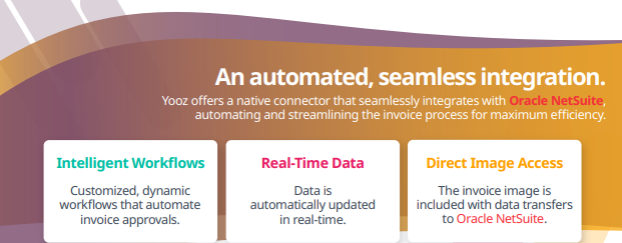

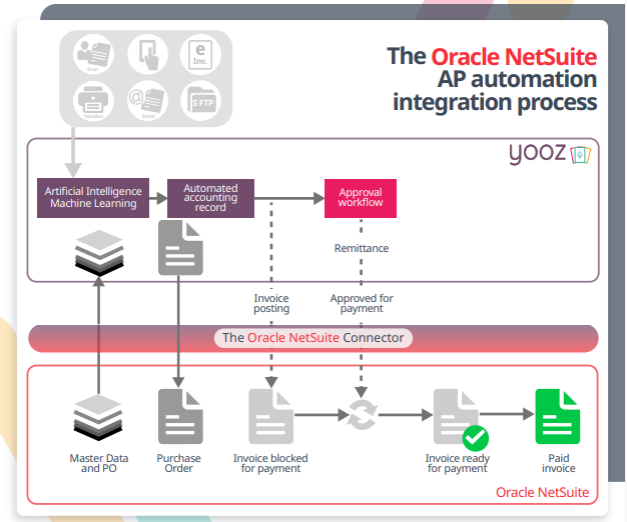

Yooz accounts payable automation is fully integrated with NetSuite, meaning that everything you do in the Yooz platform is automatically and accurately synced with NetSuite without the need to get involved.

The integration allows finance and accounting professionals to accelerate and completely automate their accounting processes, with teams benefiting from a fully efficient, secure and compliant solution. The connection between Yooz and Oracle NetSuite enables real-time information, such as the state of accounts/invoices, approved suppliers and overall cost centres, to be sent and received between the two systems.

Invoices can be received and originate from any kind of source, including email, supplier portal, or mobile. Once collected by Yooz, the technology records them in the NetSuite system, updates the information in real-time, and sends images of invoices directly to the Netsuite software to be processed - all without the need to press a single button. Yooz’s connection with NetSuite is being used by thousands of businesses and AP professionals.

What can Yooz do for your invoice processing management?

According to our research, it can take over a month (35 days) just to process one invoice. And, because these are being manually processed, each one will cost the business up to £20 to manage, not including what it costs to archive. 31% of invoices are also still being paid late, with some of them containing errors or even being paid twice.

With a digitalised invoice processing system like Yooz, invoice data is automatically extracted and recorded in the NetSuite system. Once in, automated workflows cross-reference invoice information with the purchase order and receipt and take care of the approval process.

Yooz uses powerful AI, Deep Learning and robotic process automation (RPA) to manage the entire invoice process so you don’t have to. Armed with real-time data, you can help your business reduce the risk of late payments, lost invoices and even fraud. But it’s the wider benefits to the entire business that really sets AP automation apart from other technologies, including:

- 80% decrease in costs compared to paper processing

- 5 to 20 times reduction in processing time

- Improved security and better supplier relationships with invoices always paid on time

Yooz & Oracle NetSuite: The smart choice for accounts payable automation

Yooz is a game-changer in the accounts payable automation arena, empowering businesses of all sizes to streamline their AP processes, enhance accuracy and reap substantial cost savings. Our comprehensive suite of features seamlessly automates the entire AP workflow, from invoice capture and validation to payment approval and preparation. By eliminating manual data entry and validation, Yooz eradicates human errors, safeguarding financial records and optimising efficiency. This empowers AP teams to shift their focus from mundane tasks to strategic initiatives, ultimately driving business growth.

Additionally, Yooz boasts remarkable flexibility and scalability, seamlessly adapting to the unique needs of any business. Its user-friendly interface and intuitive navigation make it a breeze to operate, even for organisations with limited IT resources.

| Benefit | Description |

| Cost Reduction | Yooz offers an 80% reduction in invoice processing costs compared to manual methods, significantly decreasing overhead expenses. |

| Time Efficiency | Speeds up AP processing, reducing invoice handling time by 5 to 20 times, allowing quicker payments and improved cash flow management. |

| Error Reduction | Yooz’s AI-driven data extraction and validation minimise human errors, preventing duplicate payments and reducing instances of fraud. |

| Seamless Integration | Yooz fully integrates with Oracle NetSuite, ensuring real-time data synchronisation and seamless workflow continuity without manual intervention. |

| Enhanced Compliance | Automatically keeps AP processes compliant with regulatory standards, such as Making Tax Digital (MTD) and securely stores documents to meet legal requirements. |

| Increased Visibility | Provides real-time data visibility, enabling AP teams to track invoice statuses, ensure timely payments and make informed strategic decisions. |

| Improved Supplier Relations | Yooz ensures invoices are paid on time, strengthening supplier relationships and helping secure potential early-payment discounts. |

| Scalability and Flexibility | Designed to adapt to business growth, Yooz’s cloud-based platform easily scales with the company’s needs and integrates additional features without complex IT demands. |

FAQ: Streamlining Oracle NetSuite Accounts Payable Automation with Yooz

What makes Yooz an ideal choice for Oracle NetSuite accounts payable automation?

Can Yooz reduce costs associated with Oracle NetSuite accounts payable automation?

How does Yooz improve invoice accuracy in Oracle NetSuite accounts payable automation?

Is Yooz adaptable for growing businesses using Oracle NetSuite accounts payable automation?

.jpg)